ABOUT US

Floyd Financial Group is an independent financial advisory firm founded in 2002 and located in Springfield, MO. Over the years we have helped hundreds of clients achieve their financial goals by providing unbiased financial advice. We have a dedicated team of individuals whose goal is to help families and their loved ones protect their assets and estates to provide financial peace of mind.

OUR CLIENTS

Request Your Complimentary,

No Obligation Review

FLOYD FINANCIAL GROUP

Shielding What Matters Most

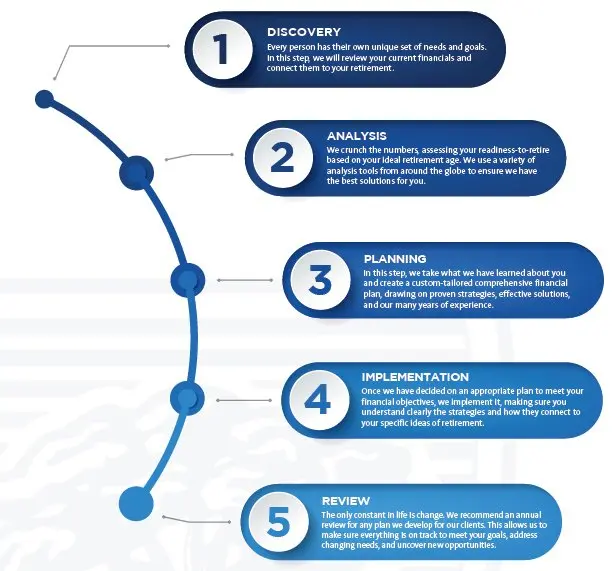

Our Process

We follow a five-step process to create your financial plan. The wonderful benefit of our five-step process is that it applies to any financial decision or concern you have. It helps you make informed decisions about your money based on facts and an experienced team of professionals to help guide you along the way. We take the time to thoroughly explore your needs no matter the stage of life you are in to help provide a custom-tailored solution that we continue to monitor and adjust until the end of time.

1. DISCOVERY

Every person has their own unique set of needs and goals. In this step we will review your current financials and connect them to your retirement.

2. ANALYSIS

3. PLANNING

4. IMPLEMENTATION

Once we have decided on an appropriate plan to meet your financial objectives, we implement it, making sure you understand clearly the strategies and how they connect to your specific ideas of retirement.

5. REVIEW